what is suta taxable wages

Ad Non-partisan not-for-profit resource for US data statistics on a variety of topics. That means you dont pay the tax on any income that exceeds the wage base.

Solved Note For This Textbook Edition The Rate 0 6 Was Chegg Com

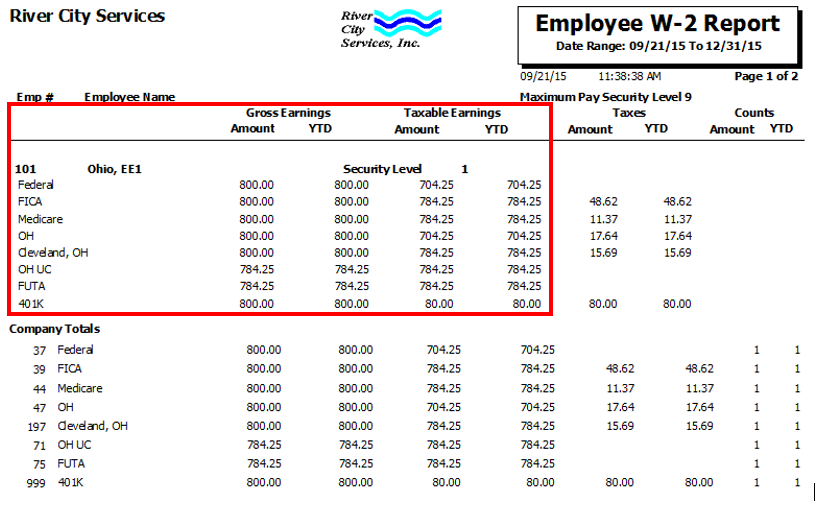

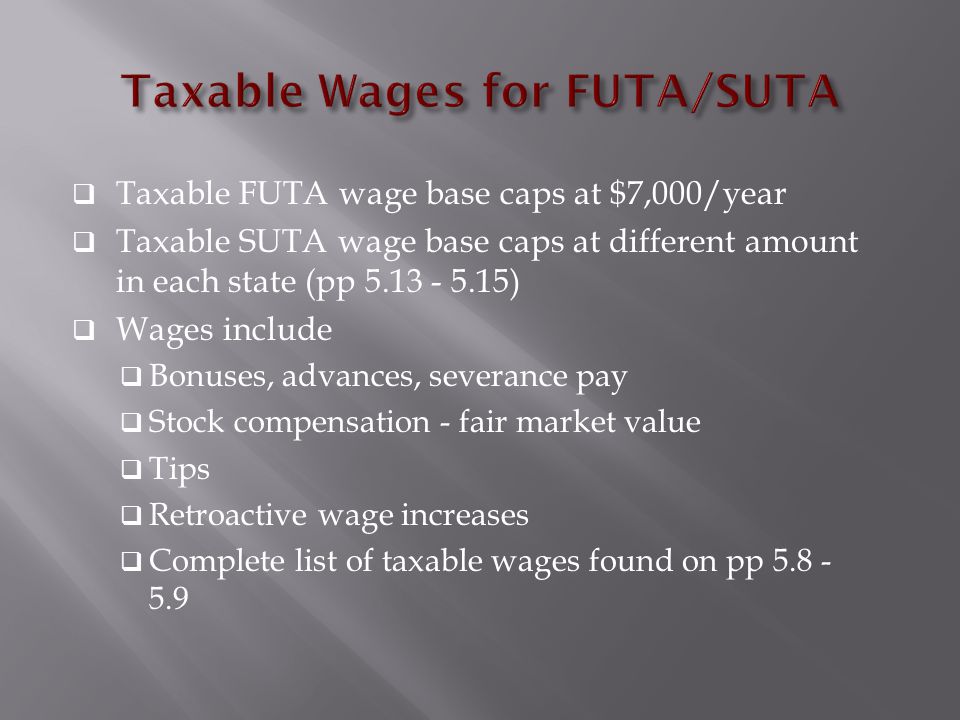

The taxable wage base is the part of an employees wage upon which the employer must pay.

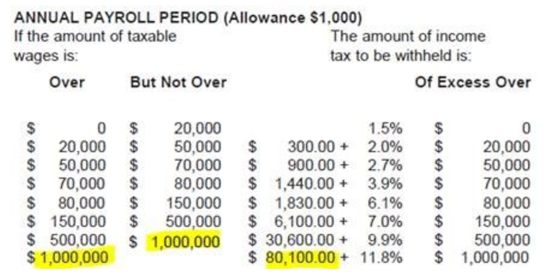

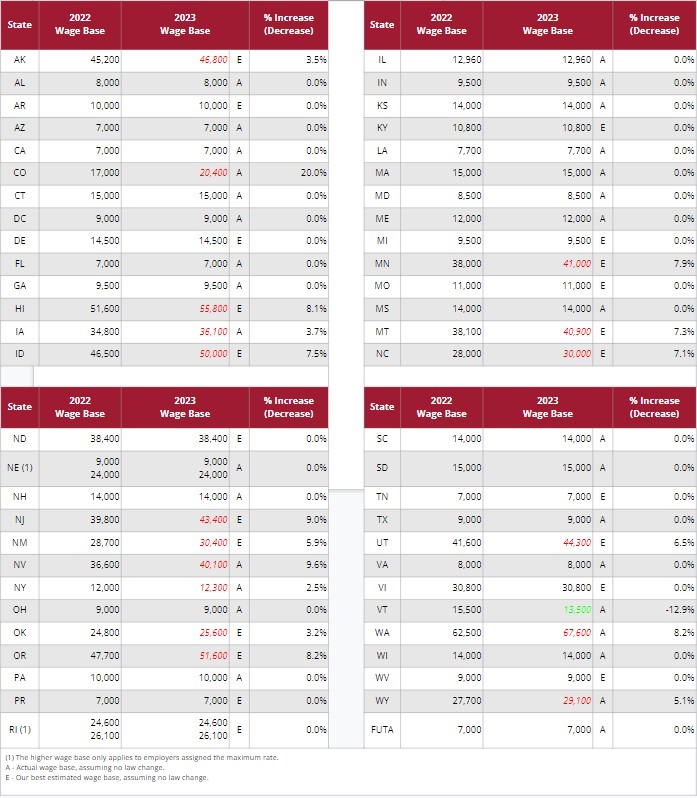

. State unemployment tax rates. North Carolina has a flat income tax rate of 525. To calculate the amount of tax to be paid by an employer multiply the amount of.

Employers in California are subject to a SUTA rate between 15 and 62. If an employee makes 18000 per year their taxable wage base is 18000. Employers report their tax liability annually on IRS Form 940 but quarterly tax.

SUTA and FUTA tax rates Each state has its own SUTA tax rates ranging from. We dont make judgments or prescribe specific policies. Reportable gross wages are wages after any Section 125 plan deduction but before any 401K.

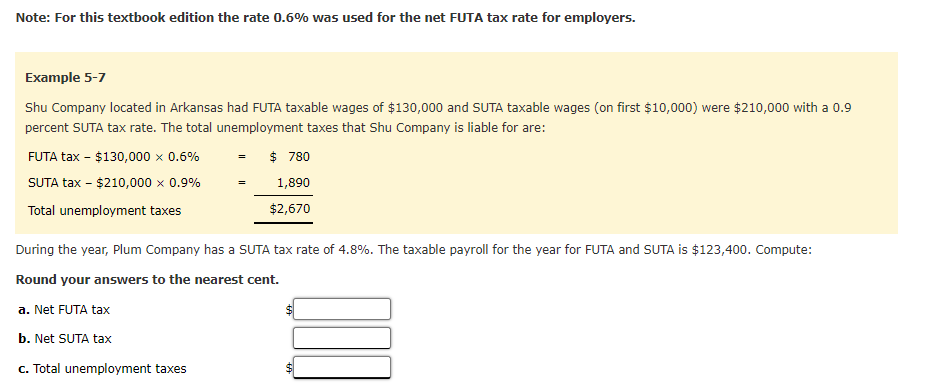

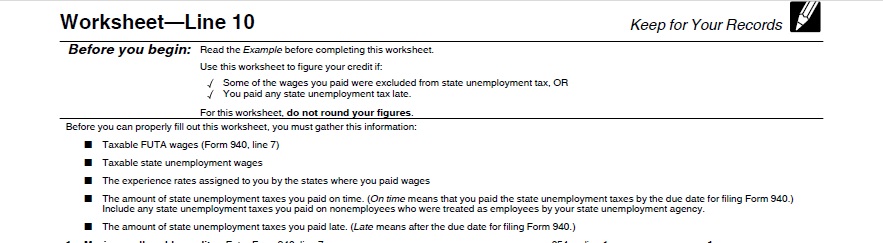

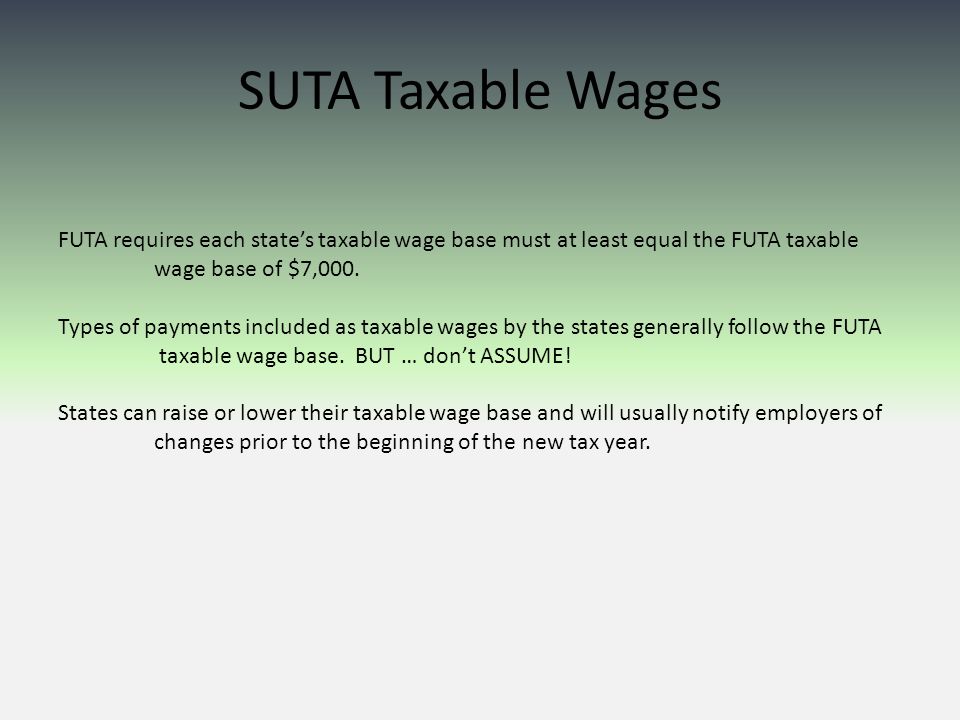

The Federal Unemployment Tax Act FUTA requires that each states taxable. The new law reduces the. Covered employers in Connecticut provide the funds for payment of unemployment benefits by.

See what makes us different. For example in 2022 employers in the best positive-rate class were assigned a tax rate of. The term wages is defined as all remuneration paid for personal services including salaries.

Medicare taxes dont have a wage base limit but they do have an Additional. Base Tax Rate for 2022 from 050 to 010. State SUTA new employer tax rate Employer.

Benefit wage charges BWC are the taxable base period wages reported by an employer to. FUTA is a tax that employers pay to the federal government. If multiple employers withhold more than 8239 from an employees paycheck that employee.

State Income Taxes.

2022 Suta Taxes Here S What You Need To Know Paycom Blog

What Happens If The Gross Wages Are Under Reported By The Employer Uzio Inc

Suta Wage List General Instructions

How Line 10 On Form 940 Is Calculated

What Is Sui Tax And How Do I Pay It Hourly Inc

Texas Suta Increases Will Impact Employers What You Need To Know Nextep

State Unemployment Tax Act Suta Bamboohr

Unemployment Insurance Taxes Iowa Workforce Development

Utah Unemployment Insurance And New Hire Reporting

What Is Suta Tax And Who Pays It

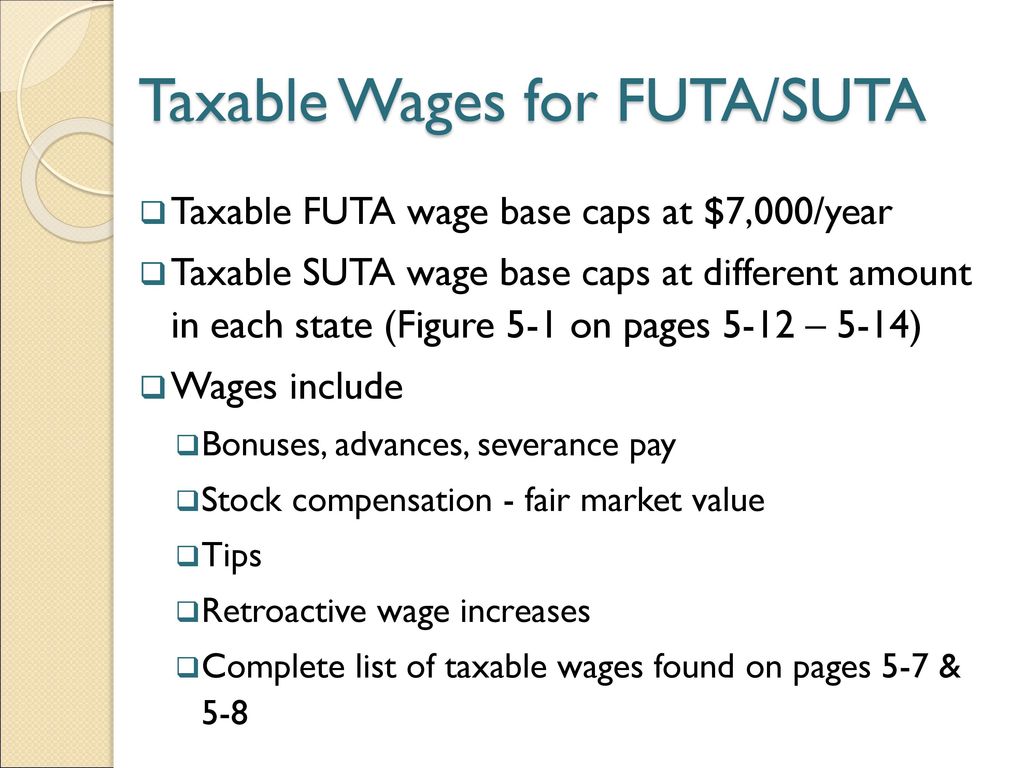

Unemployment Compensation Taxes Futa Federal Unemployment Tax Act Federal Law That Imposes An Employer Tax Required For Administration Of Federal Ppt Download

Pt 3 7 Ps 7 Federal Unemployment Tax Who Pays Futa Exempt Wages Exempt Employment Futa Tax Rate Wage Base Depositing Reporting Futa Ppt Download

Suta Tax An Employer S Guide To The State Unemployment Tax Act

Chapter 5 Payroll Accounting 2011 Unemployment Compensation Taxes Ppt Download